- School Districts

- How to Join

- If you’re a school district superintendent, trustee, or within the communications department, we’d love to share with you how Go Public is the best choice for amplifying your ISD’s voice, successes, and offerings. Click here below and we’ll set up a convenient time with your team.

-

- Regions

-

- Member Districts

-

-

- San Antonio Region MemberHouston Region MemberDallas Region MemberSan Antonio Region MemberHouston Region Member

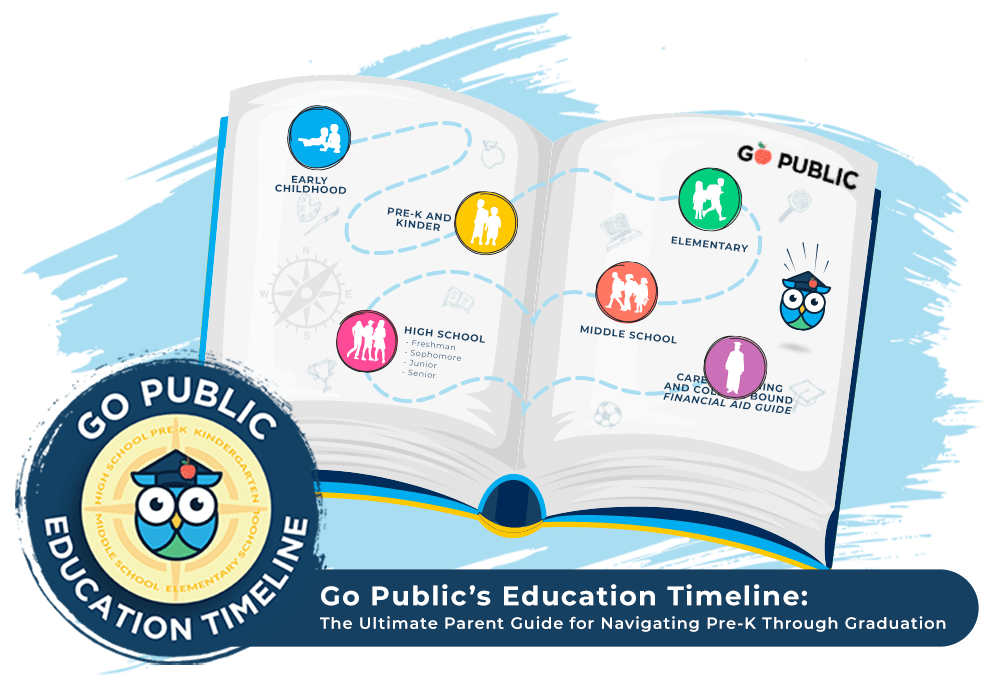

* Campaign (Go Public)

Dallas Region Member

-

-

-

- How to Join

- Programs

- Services

- Features & Events

- Parent Resources

- More

Find Texas Schools and Independent School Districts